Monthly returns for the month of March 2020, trading Index Options – Let’s discuss this,

All my trades are made on Nifty 50 Index Options because I’m not allowed to do any Intra-day trades and stock Options since I work for Finance Company. ( Prior this I used to do only Intra-day trades on stocks)

Trade summary (Mar 1st – Mar 31st)

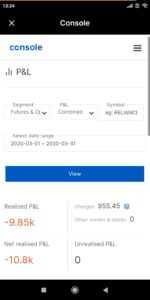

So, you can see the screenshot from Zerodha Console which says few key things like;

- Realized P/L is Rs. 9850 and

- Net Realized P/L stood at Rs. 10800

And It was quite evident that I Incurred a Charges of close to Rs. 1000.

One thing we all traders should know is the cost we incur to execute a trade irrespective of our profit or loss we gonna make from our trade.

Good part of these charges are we can claim as deductions for taxation purpose.

Which Strike Price & Why?

As far as Strike Price is concerned, if I have lot of time then I select 150-200 points away from Spot Price (Current Nifty 50 Index Value) both above and below to Spot Price. My profit margin ranges somewhere in between 50%-120% with a maximum bearable loss of 40%. ( I trade on weekly options)

If I’m equipped with some other work and still want to trade then I look at 50-100 points away from Spot Price. Here, my profit margin ranges somewhere between 7%-20% with a maximum bearable loss of 10%. ( I trade on weekly options)

When everything is going well & good, why do I ended up with Rs. 10,000 in loss in my monthly returns – the answer is simple and that is this trade.

So If my Invested value comes down by that % then I’ll book my loss and close my trade.

You might be thinking why different Profit %?

The answer is simple, the closer the strike price to the spot price the less chance of losing and less Profit Margin as well & vice-a-versa.

The one who understands this Makes Money and one who doesn’t pays it.

Because making profit in Markets is all about taking money from the other person. Every Buy order has parallel Sell order and every Profit has parallel Loss for every trade one does.

Strategy I use & How to apply it?

To be frank and precise, I don’t know anything about Charts ( apart from Basic chart) and I primarily rely on Current Conditions and Volatility in the Market. You can say that I trade on News and I feel that this is one of the most riskiest and dumbest ways to trade Markets.

Why the hell I trade on News?

The answer is quite simple – That’s what I know and It works for me!

So, the point I’m trying to make here is ‘ You do what ever you want to do and better try and test all the available strategies out their and then finalize which works best for you and stick to your strengths.’

Final Words

One bad trade, in fact in this context it’s better to say ‘ one dumb trade ‘ can eat all your profits and even make you sit in loos. So, try to be as discipline as you can and make sure everything goes according to plan.

So this is the Monthly returns for the month of March 2020, lets have a look at April here.

Until then, this is Rushi. Happy Trading!

I am extremely inspired with your writing skills and also with the format for your blog.

Is this a paid topic or did you modify it your self?

Anyway keep up the excellent quality writing, it is uncommon to see a great blog like this one today..

my webpage; Royal CBD

I’m really enjoying the design and layout of your blog.

It’s a very easy on the eyes which makes it much more enjoyable

for me to come here and visit more often.

Did you hire out a developer to create your theme?

Fantastic work!

my blog – RoyalCBD

I抦 impressed, I have to say. Really not often do I encounter a blog that抯 each educative and entertaining, and let me inform you, you’ve gotten hit the nail on the head. Your thought is outstanding; the problem is something that not enough persons are speaking intelligently about. I am very blissful that I stumbled throughout this in my seek for something relating to this.

I and also my guys happened to be digesting the best secrets and techniques located on your web blog and so quickly I got an awful feeling I had not expressed respect to the site owner for them. Those ladies appeared to be for this reason thrilled to learn them and have now really been taking advantage of those things. Thank you for indeed being simply thoughtful as well as for finding varieties of useful subject areas millions of individuals are really desirous to know about. My personal sincere apologies for not saying thanks to you earlier.

I not to mention my friends happened to be reading the good procedures found on your site then all of the sudden I had a terrible suspicion I had not thanked you for them. Those people happened to be consequently very interested to study them and have in effect in fact been taking pleasure in them. Thank you for indeed being simply kind and also for getting this sort of essential information millions of individuals are really wanting to learn about. My personal sincere apologies for not saying thanks to earlier.

I would like to show my thanks to this writer just for rescuing me from such a challenge. Right after checking through the internet and obtaining suggestions that were not helpful, I believed my entire life was gone. Living without the presence of answers to the issues you have fixed all through your write-up is a crucial case, and the ones that could have adversely damaged my career if I hadn’t noticed your site. Your good talents and kindness in touching all the stuff was crucial. I’m not sure what I would’ve done if I hadn’t discovered such a solution like this. It’s possible to at this point look forward to my future. Thanks so much for this specialized and sensible help. I will not be reluctant to refer your web sites to any person who wants and needs care on this subject matter.

I am writing to make you be aware of of the fine discovery my wife’s daughter found browsing your blog. She realized such a lot of things, most notably how it is like to have an excellent teaching mindset to let other individuals just have an understanding of specified hard to do things. You undoubtedly exceeded people’s desires. Many thanks for offering such warm and helpful, safe, informative as well as easy tips about your topic to Jane.

I have to get across my love for your generosity in support of women who have the need for help on that study. Your real commitment to passing the solution up and down became extraordinarily advantageous and has in most cases made girls much like me to realize their ambitions. The important key points denotes a whole lot to me and a whole lot more to my office workers. Thanks a lot; from everyone of us.

I have to show my passion for your kindness in support of those who absolutely need help with this important content. Your special commitment to passing the message around appeared to be incredibly significant and have continuously helped employees much like me to attain their goals. The invaluable help and advice indicates a lot to me and far more to my office workers. Regards; from all of us.

I wish to voice my passion for your kindness for people that actually need help on the subject matter. Your personal commitment to passing the message all through was amazingly powerful and has helped others just like me to arrive at their dreams. Your amazing warm and helpful guideline implies a whole lot to me and additionally to my colleagues. Thanks a ton; from all of us.

I would like to express some appreciation to you just for rescuing me from this particular setting. Because of checking throughout the world-wide-web and seeing thoughts that were not pleasant, I thought my life was well over. Living without the presence of answers to the problems you’ve fixed through your entire blog post is a crucial case, and ones that could have badly affected my career if I had not encountered the blog. The capability and kindness in handling almost everything was very useful. I don’t know what I would have done if I hadn’t come upon such a subject like this. I can at this time look ahead to my future. Thank you very much for this skilled and amazing help. I will not think twice to propose your blog post to any individual who would need care about this topic.

Thank you so much for providing individuals with such a terrific possiblity to discover important secrets from this blog. It really is so superb plus stuffed with a lot of fun for me personally and my office fellow workers to visit your site really thrice every week to read through the fresh issues you have got. And lastly, I am always pleased with all the spectacular tips served by you. Certain 3 ideas in this post are rather the most effective we have had.

I must show some thanks to the writer for bailing me out of this particular situation. Just after scouting through the internet and finding techniques which were not productive, I figured my entire life was done. Existing devoid of the approaches to the difficulties you have fixed by way of this posting is a critical case, as well as the kind which might have in a wrong way damaged my entire career if I had not come across your blog post. Your actual understanding and kindness in controlling all the stuff was invaluable. I am not sure what I would’ve done if I had not discovered such a solution like this. I’m able to now look forward to my future. Thanks for your time very much for the skilled and sensible guide. I will not think twice to endorse your site to any person who wants and needs assistance on this situation.

I simply desired to thank you very much again. I am not sure what I would’ve implemented in the absence of these tips shown by you over my situation. It has been a very challenging problem for me personally, however , understanding the specialised fashion you processed that made me to cry with contentment. I am thankful for this assistance and thus wish you realize what an amazing job you’re undertaking training other individuals with the aid of your websites. Most probably you have never got to know any of us.

My spouse and i were quite thankful when Chris managed to do his homework through your precious recommendations he received in your blog. It is now and again perplexing just to choose to be releasing solutions that the others could have been selling. And we all fully understand we now have the blog owner to thank for this. Most of the illustrations you have made, the straightforward blog menu, the friendships you give support to create – it’s got mostly spectacular, and it’s aiding our son in addition to our family reason why that subject is awesome, which is certainly incredibly serious. Many thanks for the whole thing!

A lot of thanks for each of your labor on this website. Ellie takes pleasure in managing investigation and it’s simple to grasp why. My spouse and i hear all concerning the compelling method you provide efficient tactics on this website and as well boost contribution from people on this point while our favorite simple princess is now becoming educated a whole lot. Take advantage of the remaining portion of the new year. You’re conducting a stunning job.

Thank you so much for providing individuals with an extremely splendid chance to read in detail from this website. It really is so kind plus jam-packed with a great time for me and my office acquaintances to visit your website a minimum of 3 times a week to learn the newest issues you have. And lastly, we are certainly fulfilled concerning the beautiful things you give. Some 2 points in this post are indeed the best we’ve ever had.