Question is What happened to Yes Bank – Let’s discuss it here;

Greatness of Yes Bank

Yes Bank is the fastest growing bank in the whole country and it is the 4th largest Private Bank. Yes Bank has more corporate partners than any other bank and those corporate’s are big one’s like PhonePe, Flipkart, Swiggy, Redbus & other’s, for more you can refer to this.

Yes bank accounts to more than 35% UPI transactions across the country. Yes Bank is the Big Boy in the Fintech Space, to know more you can look into this. I used almost every bank’s Mobile Banking App and I felt Yes bank has the simplest of it’s kind & it’s quickest service and above all great brand.

They were more than 2 lakh Crores deposits ( Note this point, interesting fact is coming up ) and the employee base of more than 18000.

Why should you invest in Yes Bank

The Issue Price for Yes Bank’s IPO is at Rs. 45 way back in 2005 and it hit the all time high of Rs. 400 ( After Considering Split of 10:2 which was made on 21st Sep, 2017) and the all time low’s of Rs. 5.55 and Currently it is trading at Rs. 28.8 ( As of Mar 11th, 2020)

Rana Kapoor Co-founder of Yes Bank, who is quite aggressive and always willing to do more than expected and surprise everyone with the results he used to get. At one point Yes Bank is Fastest growing Bank and it’s Loan Book is on rise and I think it might touched the sky as well 😉

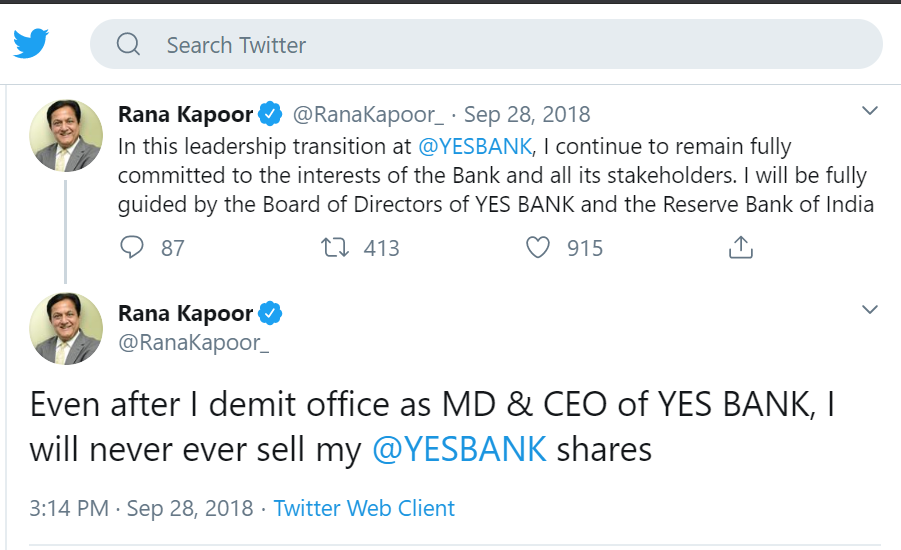

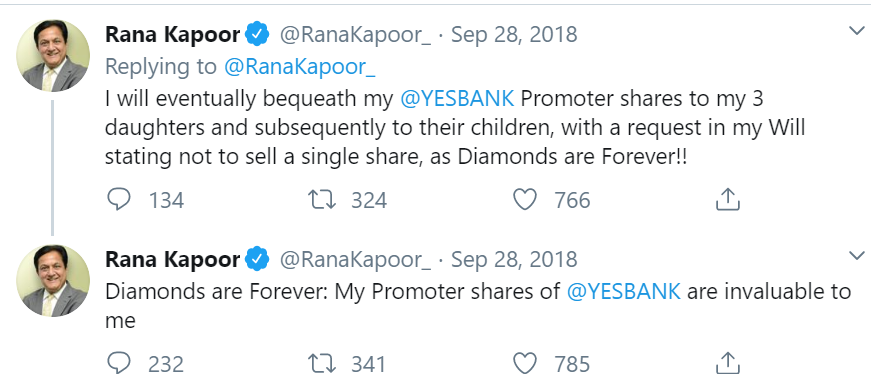

Just have a look at these tweet’s made by CEO himself on Sep 2018 exactly 1 year after Shares were Split ( Note this point as well because things are getting interesting…)

And these tweet’s were followed by another set of tweet’s, which were even more seducing to buy the stock at hefty valuations…

What went wrong when everything is under control

Aggressive Expansion by allotting loans to those sectors and those companies which doesn’t have potential to repay it. Forget about the principal amount these companies operations were also not sound enough to pay even the interest amount on time. But still they allotted because the Interest rate is way higher than the peers in the Industry. ( Source – Annual Report)

They ended up giving more loans to Sick companies, Stressed Companies and the story began here, back in 2015 UBS report had raised a Red flag about this exponential growth. Just look at the loan book on yearly basis;

| FY 2014 | Rs. 55,000 cr |

| FY 2015 | Rs. 75,000 cr |

| FY 2016 | Rs. 98,000 cr |

| FY 2017 | Rs. 1,32,000 cr |

| FY 2018 | Rs. 2,03,000 cr |

| FY 2019 | Rs. 2,41,000 cr |

Now it has a loan book of over Rs. 3 lakh Crores but it’s deposits were only Rs. 2 lakh Crores and out of these loans the NPA’s ( Non Performing Asset – Not collected with in 90 days from the date of payment accrued ) has also rose significantly over the years and it reached to the record level.

Role of RBI

In 2017, RBI noticed that NPA’s of Yes Bank is increasing constantly and RBI also felt that there are 5x more NPA’s which Yes Bank is not disclosing and the day came and RBI asked Yes bank to come with cleaned Books of Accounts ( RBI found Half a Billion $ more NPA’s ) & Drama Begins…

Sep 2018, RBI decided to remove CEO Rana Kapoor from the board from Jan 2019 to save bank from going bad to worse and the Interesting part here is all the tweets you had seen above are made on Sep 28th, 2018 better you can recheck once.

Nov 2018, top management started leaving the company &

Dec’18 to Mar’19 – Stock was very volatile in the markets and only few people know the reason why

Mar 2019, Ravneet Gill has became new CEO of Yes Bank

April 2019, For the first time in the history of the company, Yes Bank has posted its Maiden Loss in it’s Q4 Results and stock was down by more than 30% . A fellow trader told me this;

Rushi, I cleared all my debts with this single trade.

He brought few lots of Put option just 2 days before the quarterly results, if I’m not wrong he made a profit of close to Rs. 1.5 lakh’s. ( This is totally a different story altogether, will discuss some other time)

I asked you to Note few points and hope you remember, if not you can revisit because almost after 1 year the Co-founder & Former CEO Rana kapoor tweet’s were made ie;

On Nov 2019, he sold almost all the stack he has in Yes Bank, despite of his promise through tweets

Another fellow trader told me;

I invested close to 1 lakh after seeing the tweets made by Mr. Rana

And the sad part here is ‘ She is still holding the stock with a Avg Buy price close to Rs.200 ‘, after listening to this then I realized the these words from Zerodha Founder.

As of March 2020, RBI took over the bank’s operations and declared Moratorium by saying depositor’s, you can’t withdraw more than Rs. 50,000 till April 3rd.

Exceptions are;

You can request to make a bigger withdrawal, subject to conditions that include a maximum limit of Rs. 5 lakhs.

- To pay for medical treatment

- To cover higher education costs, in India or abroad

- To pay for “obligatory expenses” for a wedding or other ceremonies

- In “any other unavoidable emergency“

The stock was down by more than 50% and the whole market took blood bath on that day ie; March 5, 2020. Most probably this Moratorium will end in a week or two.

Current status of Yes Bank

- RBI took over the operations and appointed SBI’s former CFO as Administrator,

- Mr. Rana Kapoor was arrested by ED on Money Laundering allegations,

- Declared Moratorium and the whole bunch of people hit the bank branches in no time,

- All the business had gone for peers like ICICI Bank, Axis Bank…etc

- Big hit on Brand called ” Yes Bank “

But despite of all these above points the share price in the market is doing quite well.

Why SBI?

SBI along with few others like LIC, HDFC Bank will buy 49% stake for somewhere in between Rs. 2400 Cr to Rs. 5000 Cr.

This is not new and it is continuing because country like India can’t afford to loose a bank like Yes because the public perception changes and no one puts their money in banks ( What happens when Bank goes bankrupt ) and in fraction of seconds the whole country will collapse because –

For any country Financial Sector is the Backbone and No one want’s to get broke.

Investors holding Yes Bank shares

So, now you have to tell me what is your Avg Buy Price and how much Quantity you’re holding. I narrated the whole story to you & you have to tell me whether you want to Hold or Buy more or Sell. You should refer to the below point ie; As on Mar 14, right now.

Thinking to Buy Now

If you have not yet Invested in Yes Bank and looking at the current scenario if you fell like investing in it then you can go ahead and do it. Because, I explained the pro’s & con’s to you and the final decision is your’s.

If you buy now & win it then credit goes to you. If loose then you have to take the blame as well.

What I’d like to do

I would like to do Intra-day trades because I love volatility and litigation stuff. This stock will be very volatile for next 5 – 6 months till everything comes under control. Best thing to trade is ‘ Volatility ‘.

The reason is simple –

The risk reward ratio is very attractive when compared to other options.

As on Mar 13

Along with SBI, LIC & HDFC Bank, the likes of Kotak Mahindra Bank, ICICI Bank, Axis Bank has also brought some stake in Yes Bank. You can refer to this.

As on Mar 14

RBI & Finance Ministry took a dare decision and they convinced all the stake holders on that decision and that dare decision is 3 year lock in period for all the investors including retail investors like you & me up to 75% of stake. You can refer to this.

Exception to this –

SBI can sell where ever they want to sell and No Lock – in period for them & other lucky boys are Investors who hold less than 100 shares.

Why this Lock In period?

Just to keep this stock bit stable in the market and avoid high volatility. Just to keep it in simple terms

Govt don’t want to give extra advantage for the people like me, who trade volatility.

I encourage this move because country like India do need investors not speculators.

Let me know your views as well and willing to hear more from you.

Until then, this is Rushi. Happy Trading !

I am just writing to make you be aware of of the impressive discovery my wife’s princess went through visiting your web site. She mastered too many pieces, which included what it’s like to possess an excellent coaching character to make the mediocre ones with no trouble completely grasp selected problematic things. You undoubtedly did more than visitors’ expected results. Thanks for delivering these productive, safe, educational and in addition unique guidance on your topic to Ethel.

My husband and i got very more than happy Albert managed to finish up his analysis because of the ideas he obtained in your weblog. It’s not at all simplistic to simply choose to be giving freely information which often some people could have been selling. And now we do understand we have got you to thank for that. All the explanations you’ve made, the easy blog menu, the friendships you will give support to instill – it’s got many impressive, and it’s really helping our son in addition to our family understand the theme is satisfying, which is certainly exceptionally vital. Thanks for all!

I simply needed to thank you very much again. I am not sure the things that I would have undertaken without the entire tactics revealed by you concerning this topic. It seemed to be a frightful scenario in my circumstances, but coming across a new well-written manner you processed the issue made me to jump over gladness. I will be thankful for this work as well as have high hopes you really know what a great job you were doing educating many people by way of your webblog. I am certain you’ve never met any of us.

Thanks a lot for giving everyone such a superb possiblity to read articles and blog posts from this website. It can be very ideal plus packed with amusement for me and my office acquaintances to search your blog a minimum of 3 times in a week to learn the latest issues you have. And of course, we are always amazed with all the splendid advice you serve. Selected 3 facts in this post are unquestionably the simplest I’ve ever had.

My husband and i ended up being very more than happy when Ervin managed to deal with his investigations through the entire precious recommendations he grabbed through your weblog. It is now and again perplexing to just choose to be giving freely helpful tips that many a number of people could have been making money from. We really do know we’ve got the website owner to give thanks to for this. All of the illustrations you have made, the easy site menu, the relationships you make it possible to promote – it’s got all overwhelming, and it is aiding our son in addition to us consider that that situation is brilliant, and that is pretty essential. Many thanks for the whole thing!

Thank you for your whole efforts on this blog. Ellie take interest in conducting internet research and it’s really easy to understand why. My spouse and i hear all of the compelling manner you make simple tactics on this web site and even foster contribution from others on that topic then our favorite simple princess is really discovering a lot. Have fun with the rest of the new year. You’re conducting a really great job.

Needed to compose you this very small observation just to give thanks once again relating to the marvelous suggestions you’ve featured above. It’s so unbelievably generous of people like you to give freely all that a few people would’ve offered as an e-book in order to make some cash for themselves, specifically considering that you might well have done it in case you considered necessary. Those secrets in addition worked to be a easy way to be sure that the rest have similar interest similar to my personal own to find out way more with regard to this condition. I’m sure there are some more fun opportunities up front for individuals who find out your blog post.

I am glad for commenting to let you understand of the really good encounter my cousin’s child enjoyed studying your blog. She mastered too many things, which include what it’s like to possess a great coaching character to have the others really easily understand specific hard to do things. You really did more than her expectations. Thanks for imparting the practical, healthy, explanatory and in addition easy guidance on the topic to Kate.

I truly wanted to develop a simple word to express gratitude to you for all of the lovely advice you are posting at this site. My long internet investigation has now been honored with reasonable tips to exchange with my classmates and friends. I ‘d say that we site visitors actually are quite endowed to live in a fantastic network with so many outstanding people with very beneficial opinions. I feel rather privileged to have used the web page and look forward to plenty of more excellent times reading here. Thanks a lot again for all the details.

I want to express thanks to this writer just for rescuing me from such a setting. As a result of looking throughout the world wide web and seeing advice which were not pleasant, I believed my life was over. Being alive devoid of the approaches to the issues you’ve solved through your entire article is a crucial case, as well as those that might have in a wrong way damaged my career if I had not discovered your site. Your good competence and kindness in taking care of a lot of stuff was precious. I’m not sure what I would’ve done if I had not come upon such a step like this. I’m able to at this point look forward to my future. Thanks a lot very much for your skilled and results-oriented guide. I won’t be reluctant to endorse your web site to any individual who should have support about this subject matter.

I’m just commenting to make you be aware of what a magnificent discovery my child gained going through your webblog. She realized too many pieces, not to mention what it is like to possess an ideal helping heart to get a number of people completely understand selected complicated subject matter. You actually exceeded readers’ expectations. Thanks for churning out these valuable, dependable, revealing and in addition unique tips on your topic to Kate.

Thank you so much for giving everyone an exceptionally terrific chance to read critical reviews from here. It is always so amazing and as well , full of amusement for me personally and my office friends to visit your blog at the very least 3 times in one week to study the latest stuff you will have. Not to mention, I’m so at all times impressed considering the powerful ideas you serve. Certain 4 points in this posting are without a doubt the finest we’ve had.

I have to express my gratitude for your kind-heartedness giving support to persons who absolutely need help on that study. Your personal dedication to getting the solution throughout came to be quite useful and has in every case helped regular people just like me to get to their pursuits. Your amazing invaluable information signifies a lot a person like me and further more to my colleagues. Best wishes; from all of us.

I wish to get across my love for your kind-heartedness supporting persons that have the need for help with this particular matter. Your real dedication to passing the solution around became definitely advantageous and have really encouraged regular people just like me to reach their aims. Your new informative information implies a great deal a person like me and a whole lot more to my colleagues. Thanks a lot; from all of us.

My spouse and i have been really delighted that Peter could carry out his web research out of the precious recommendations he discovered out of your web site. It is now and again perplexing just to always be giving out tips that many the rest have been trying to sell. We really know we have you to be grateful to for this. The main illustrations you made, the straightforward web site navigation, the relationships you can help to promote – it’s got many unbelievable, and it’s really helping our son and our family imagine that the issue is pleasurable, and that is unbelievably pressing. Thanks for all the pieces!

Thank you a lot for providing individuals with such a superb possiblity to read from this website. It is always very pleasant and as well , stuffed with a great time for me and my office fellow workers to visit your web site at the least three times in 7 days to study the newest secrets you have got. And definitely, I’m just actually satisfied considering the astonishing tips and hints you serve. Some 4 ideas on this page are definitely the simplest I have ever had.